by ADA | Jan 30, 2024 | Uncategorized, Views

Sources quoted by authorities to clamp down on the art market rarely stand up to scrutiny

How does false data come to influence policy and even law making on such a widespread basis when it comes to cultural property?

One reason is confirmation bias: if the results of your research match what you hope to find, you are less likely to check their validity – a point made by statistics guru Dr Tim Harford when discussing claims made about antiquities and crime.

Another can be the authority of the source. This is very common in the cultural heritage sphere.

This two-part article analyses two studies from what should be an impeccable single source, showing how false data can spread from one official report to another to gain traction, and ultimately become an unchallenged authority among those who should know better.

They also demonstrate that many apparently learned pieces of research published by acknowledged authorities simply can’t be trusted, because it is clear that these professionals are not checking their sources adequately.

Both reports were published by the United Nations Office of Drugs and Crime (UNODC).

One was titled PRACTICAL ASSISTANCE TOOL to assist in the implementation of the International Guidelines for Crime Prevention and Criminal Justice Responses with Respect to Trafficking in Cultural Property and Other Related Offences. It was published in 2016.

The two relevant claims it included were as follows:

• The Museums Association has estimated that profits from the illicit antiquities trade range for $225 million and $3 billion per year.

AND

• The Organized Crime Group of the United Kingdom Metropolitan Police and INTERPOL has calculated that profits from the illicit antiquities trade amounted to between $300 million and $6 billion per year.

Footnotes indicated the source for each of these statements.

For the first it was “See Neil Brodie, Jenny Doole and Peter Watson, Stealing History: The Illicit Trade in Cultural Material (Cambridge, McDonald Institute for Archaeological Research, 2000); and Simon Mackenzie, “Trafficking antiquities” in International Crime and Justice, Mangai Nataajan, ed. (Cambridge, Cambridge University Press, 2011).”

For the second it was “United Kingdom, House of Commons, Culture, Media and Sport Select Committee, Cultural Property: Return and Illicit Trade, seventh report, vols. 1, 2 and 3 (London, 2000).”

These were very precise references, if rather out of date for a 2016 report by the UNODC.

The problem is that whoever researched the UNODC report failed to check where its quoted sources got their data from. If they had, they would have found the following:

– The Brodie, Doole and Watson report from 2000 did not refer to the Museums Association $225 million and $3 billion per year claim at all. Instead, on page 23 in the introduction to section 1.9, The Financial value of the illicit trade, it stated: “Geraldine Norman has estimated that the illicit trade in antiquities, world-wide, may be as much as $2 billion a year.” The footnote for this statement identified the source as journalist Geraldine Norman’s November 24, 1990, Independent article Great sale of the century. However, apart from the fact that the article was actually titled Great sale of the centuries, it included no such claim or figure.

The Simon Mackenzie chapter on Trafficking Antiquities is not open source data, but is available on subscription to CUP.

– In fact, the Museums Association did give estimated figures as part of its evidence to the UK House of Commons, Culture, Media and Sport Select Committee, Cultural Property: Return and Illicit Trade, seventh report, vols. 1, 2 and 3 (London, 2000) – the same source as the second claim quoted by the UNODC. In the Seventh Report, Chapter II The problem of illicit trade, The nature and scale of illicit trade, paragraph 9 reads: “The scale of the illicit trade taken is said to be very considerable. According to the Museums Association, as an underground, secretive activity, it is impossible to attach a firm financial value to the illicit trade in cultural material. Estimates of its worldwide extent vary from £150 million up to £2 billion per year.” The Museums Association gave as its source the Brodie, Doole and Watson 2000 report, quoted above, which in turn gave the Geraldine Norman article as the source, when, in fact, it provided no such figures.

So, the Museums Association’s actual claim was that “it is impossible to attach a firm financial value to the illicit trade in cultural material”, but that estimates worldwide [by others] varied greatly between £150 million and £2 billion.

This was rather different from the UNODC claim based on this source: “The Museums Association has estimated that profits from the illicit antiquities trade range for $225 million and $3 billion per year.”

To summarise, then, the £150 million to £2 billion claim ultimately came from nowhere. Its claimed primary source, the Geraldine Norman article from 1990, quoted no such figures. The secondary source which mistakenly quoted them was the Brodie, Doole & Watson report from ten years later in 2000, leading to the tertiary source of the Museums Association. In turn, this was quoted by the UNODC in 2016 – 26 years after the Norman article which gave no figures anyway. The UNODC report then became a new ‘primary’ source, with the figures quoted as UNODC estimates, which they weren’t at all.

See Part 2

by ADA | Oct 27, 2023 | Uncategorized, Views

Three developments in recent weeks have raised questions once again about the activities of the Manhattan District Attorney’s office and its antiquities unit. Separately they are of concern; together they demand some clear answers.

The first involves the claim that 19 items returned to Italy as “illicit” were worth $19 million. The figures simply didn’t add up according to expert valuers from the Antiquities Dealers’ Association, who noted that the South Italian plate included was worth up to about $7,000 at auction, but “only if it were to have a good provenance”.

When asked by Antiques Trade Gazette how the unit had arrived at the valuation, the D.A.’s office replied: “We have experts assess the objects at the time of each repatriation based on the legal definition of value under the law.”

Who these experts are and how they arrived at such an overblown valuation remains a mystery.

This matters because:

- What appears to be a gross exaggeration of value feeds into the inaccurate narrative of a huge international illicit trade in artefacts.

- It also boosts the public standing of the antiquities unit, which in turn makes its unquestioned position all the more unassailable at a time when serious questions regarding its activities need to be asked.

- The unit’s activities are funded from the public purse, so the public is entitled to accurate reporting and transparency.

If the above is an accurate assessment of the situation, it raises a raft of new questions.

One of those questions involves the second development: the D.A.’s publishing of a media release that led to inaccurate reporting on the criminal status of individuals.

Having unequivocally labelled a number of named individuals as “major antiquities traffickers” in the opening paragraph, an unheralded footnote states: “The charges referenced within are merely allegations, and the individuals are presumed innocent unless and until proven guilty.”

The failure to annotate the body of the release with a reference to the footnote inevitably risks misreporting, especially by those who fail to read to the end of the release. An internet search has revealed at least two examples of this happening in this case. Why is this not of serious concern to the Manhattan D.A.?

Cleveland Museum of Arts sues the D.A. over statue seizure

One of the most significant developments has come at the hands of the Cleveland Museum of Arts, which is now suing the D.A.’s office over its seizure of a headless ancient bronze statue valued at $20 million.

The D.A.’s office argues that it is of Marcus Aurelius and was looted from Turkey. The museum, which acquired the statue in 1986, says that is not the case.

As the court papers reveal, Turkey made vague and unsubstantiated claims regarding the statue around 15 years ago but did not respond when asked for evidence to support its case and did not pursue the matter further until now.

As the statue had been widely exhibited and written about over the years, Turkey had had a long time to press its case but did not do so. This was also the case when Turkey failed in its claim over the Guennol Stargazer in the New York courts. Among other comments in 2021, U.S. District Judge Alison Nathan noted that Turkey had known of the piece for years and had had ample opportunity to make a claim but had failed to do so in a timely manner.

The Cleveland Museum of Art’s court papers highlight the controversial approach of the Manhattan District Attorney’s office in seizing objects and returning them to source countries: “For more than ten years, the New York County (Manhattan) District Attorney has conducted numerous investigations of antiquities allegedly stolen from foreign nations, returning many of them to those nations. Proof that these items are “stolen” typically is established using the laws of such nations (“patrimony laws”), which, among other things, declare that items of a certain age or type belong to the nation. If a covered object is then illegally exported after the effective date of the patrimony law, the argument is made that it is stolen property.

“Unlike typical criminal investigations, the New York District Attorney’s primary purpose appears to be to return antiquities to their countries of origin or modern discovery, assuming the office can verify the appropriate country.”

The court papers also note that when such returns are made, the media report the returns as involving “looted antiquities” – evidence of any such looting, if it exists, is rarely made clear.

As ADA chairman Joanna van der Lande wrote to ATG in the wake of the $19 million claim: “It’s time that the media challenged official bodies, from the Manhattan D.A.’s office to UNESCO, the European Commission, Europol and others, and subject them to the same level of scrutiny that they apply to the market rather than just accepting what they put out in statements. Let’s have the same transparency and due diligence when it comes to ‘facts’ that these bodies so readily demand of dealers and auction houses in relation to objects.”

by ADA | Aug 29, 2023 | Uncategorized, Views

Even when an antiquities dealer proves to be the hero of the hour, the media and others try to blame the market instead of those responsible

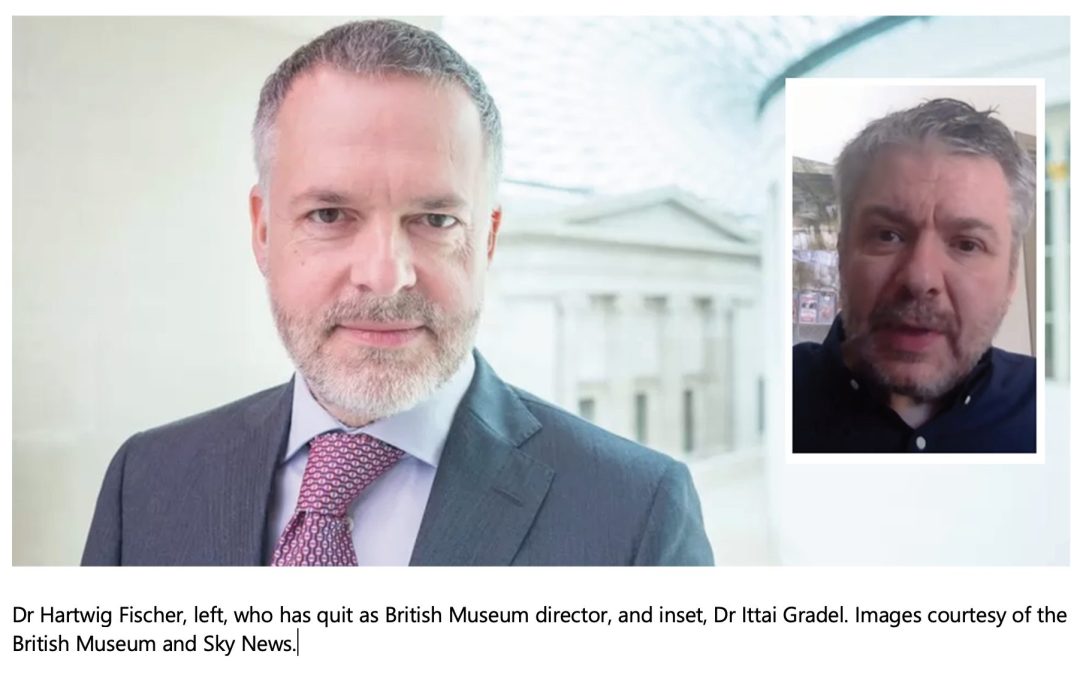

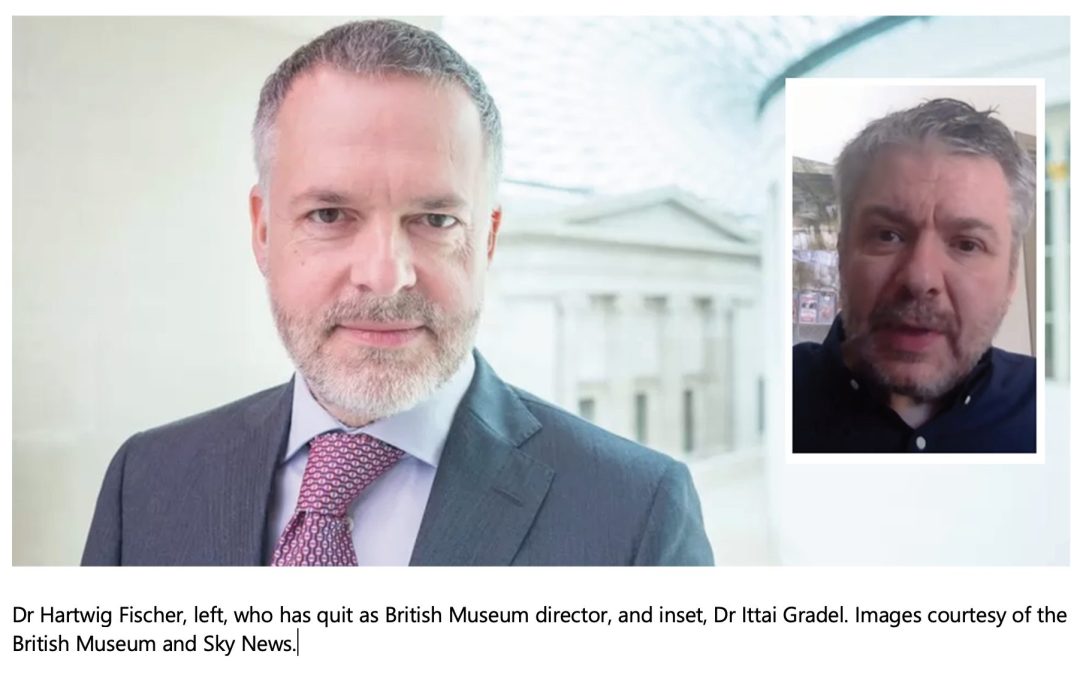

Much of the past ten days has been taken up with the thefts scandal at the British Museum. A senior curator sacked, the director of the museum quitting early, and the deputy director stepping back from duties pending an investigation.

Covered in disgrace, senior executives made their position worse by attempting to divert blame to the man who had blown the whistle in the first place, even though he had spent several years trying to get them to take him seriously.

Why did they think they might get away with it? Perhaps because Dr Ittai Gradel, an academic and collector of antiquities, is also a dealer. And perhaps, too, because history shows us that the media are all too ready to believe the worst of the trade even when confronted by evidence to the contrary.

BM director Dr Hartwig Fischer was quoted as follows: “When allegations were brought to us in 2021, we took them incredibly seriously, and immediately set up an investigation.

“Concerns were only raised about a small number of items, and our investigation concluded that those items were all accounted for.

“We now have reason to believe that the individual who raised concerns had many more items in his possession, and it’s frustrating that that was not revealed to us as it would have aided our investigations.”

Dismissing these claims as “lies”, Dr Gradel accused the director of “shooting the messenger”: “They never even contacted me. I was waiting the whole time for them to ask me to give testimony. Why can’t they just own up to their responsibility?”

Excoriating censure by the Telegraph

Fortunately The Telegraph, which had secured the scoop on the story, had conducted a thorough investigation of the email trail between Dr Gradel and the BM, so it knew who was telling the truth. It went so far as to publish a leader article on August 25 censuring the BM management: “Although the British Museum ostensibly opened an investigation, it reached a swift conclusion that nothing untoward had happened. Now we know that was not the case… the whistleblower gave the British Museum the opportunity to stem the disappearances without publicity. For it to supposedly take no action was a dereliction of duty and has made it harder to argue against demands for the repatriation of important parts of the collection such as the Elgin Marbles.”

Most damningly, the Telegraph concluded: “Why are those accused of ignoring warnings still in post? If they refuse to resign then George Osborne, the UK’s former chief finance minister and now museum’s chairman, should dismiss them for tarnishing the reputation of a great institution.”

While Dr Fischer’s crisis management proved a disaster for him and the museum, as one of the two most senior government ministers in the land during the David Cameron premiership, Mr Osborne is a seasoned politician with a much more authoritative grasp on the playbook of public opinion and reacted accordingly to limit the damage. He revealed that some items had been recovered, calling it “a silver lining to a dark cloud”.

In a BBC interview, Mr Osborne also revealed what he thought had gone wrong in the failure to address Dr Gradel’s concerns promptly: “…was there some potential groupthink in the museum at the time, at the very top of the museum, that just couldn’t believe that an insider was stealing things, couldn’t believe that one of the members of staff were doing this? Yes, that’s very possible.”

IADAA and ADA adviser Ivan Macquisten was quoted in The Times, explaining the importance of the trade’s role in crime prevention, as the media turned its attention to the unwelcome challenges that the possible sale of so many stolen items might pose.

It became clear that many of the missing items had never been properly catalogued or photographed, meaning they will probably never be identified or restored to the British Museum’s collection. Nonetheless, the most strenuous efforts must be made to recover as much as possible.

Trade associations launch media campaign over crisis

Both IADAA and the ADA launched a media campaign on August 25 calling on the British Museum to publish a full list of the missing objects, together with photographs, prominently on its website as a matter of urgency so that the trade and others can help in their safe recovery. Mr Osborne has said that only the police can publish a list on the Interpol website and that the BM is working with the Art Loss Register, adding that simply publishing the list itself might not bring the best response. This was unconvincing. The Art Loss Register is unlikely to focus on less important items among those stolen, and regardless of what other measures the BM is taking, it should also publish the list prominently on its website to ensure the greatest public awareness in the quest for recovery. If that is too much to ask, the least it could do is to provide the correct information to dealers and auction houses for enhanced due diligence.

Despite it being a member of the antiquities trade who devoted four years to uncovering the scandal and reporting it, some commentators have used the scandal to attack the trade.

Foremost of these is anti-trade campaigner Morgan Belzic, doctor in archaeology at the French Archaeological Mission in Libya, who reportedly told classicist Daisy Dunn, also writing for The Telegraph: “The London art market is one of the most involved in antiquities theft and looting… It can move objects very easily and quickly out of the country. It’s one of the least controlled markets in the world. There’s a lot of complacency, a lot of negligence and, of course, some dealers are directly involved with the illegal trade.”

Belzic stuck the knife in further with bogus statistics: “I’d estimate the legal art and antiquities market is only 20 per cent of the total trade,” he said. “It’s impossible to give an accurate number, so little research has been done in the field, but the illegal trade is certainly in the billions [of pounds].”

If it is impossible to give an accurate number, how can he estimate that the legal market is only 20 per cent of the total trade?

He is clearly also unaware of the recently published Cambridge University paper by Dr Neil Brodie and Assistant Professor Donna Yates, The illicit trade in antiquities is not the world’s third largest illicit trade: a critical evaluation of a factoid, or the 2020 RAND report, the latter of which demonstrates convincingly why any illicit trade in antiquities could not be worth billions of dollars – a logical point earlier noted by the ADA’s and IADAA’s own analysis.

Hypocritical approach of trade’s critics

Belzic follows the pattern of many critics of the trade by demanding unquestionable documented provenance for their claims over artefacts, while considering himself free to make wild, inaccurate and damaging claims about the trade without offering any provenance to support what he has to say. He makes a very serious allegation, accusing London dealers of criminal activity. If he has proof of this, why does he not name them? His careless approach is irresponsible.

The additional problem with this is that it is such critics, spreading the bogus claims over an illicit trade worth billions of pounds, who themselves risk encouraging further looting by those who think they are going to make a fortune from such thefts when the reality is otherwise.

One of the more important aspects of this whole sorry saga is the spotlight it has thrown on the politicisation of the museum sector and how it is run. In a letter to The Times on August 25, the former curator of Salisbury Museum, Peter Saunders, agreed with an earlier comment piece decrying the way that museums were losing their way: “…museums have too long felt pressured by funders and politicians to focus on flavour-of-the-month matters such as decolonisation, equality, diversity, restitution and climate change, to the detriment of basic, old-fashioned curatorship. Cataloguing and security are unglamorous activities. Yet might a national scheme to mark all collections with DNA identifiers to deter theft and aid police recovery of stolen artefacts not prove attractive to sponsors? It would surely help prevent the sort of ‘plundering’ suffered by the British Museum.”

The scandal has also led to other issues coming to light. In an August 18 article, Thefts by staff a common problem in UK museums, say experts, The Guardian reported on claims from a former London Museum employee that the sector was :”institutionally corrupt”, with the theft of items being considered “fair game”.

Even after all this, with Dr Gradel doing everyone the greatest of favours by his hard work and determination – and the museum world exposed as having a very serious institutionalised problem – elements of the media exploited the crisis to attack the trade once more.

Article full of unwarranted smears

In an article that didn’t even bother to consult anyone in the trade, on August 28 The Guardian fired a series of unprofessional and unsubstantiated smears against the market, starting with: “Close observers of the antiquities market tend to be a cynical bunch, having witnessed any number of scams, dubious practices and illicit trading.”

In what appeared to approach a defamatory line, it went on to ignore all the reasons Dr Gradel had given to explain why he had kept in contact and continued to buy from the BM thief – building a case, keeping him on the hook etc. Instead it questioned his probity: “After all, the only reason the story about the British Museum has come to light is because a Danish antiques dealer, Ittai Gradel, says he became suspicious about a dealer with whom he continued trading for several years.”

It then added to the insult with the following:

“According to Gradel, he alerted George Osborne, the museum’s chairman, after being “fobbed off” by its managers for two years. Apparently he first had doubts about one seller back in 2016, when he recognised an item he’d seen many years before at the British Museum. When he asked the seller, whom he’d been dealing with since 2014, where he came by his objects, he was told that the man’s grandfather had owned a junk shop in York between the wars.

“That’s the kind of cover story that allows both parties involved to continue with business without having to explore any more awkward questions or pay an expert to establish provenance, even though it is a dealer’s legal responsibility to do just that.

“It took Gradel a further four years before he says he realised that he had been inadvertently handling the seller’s stolen goods. And that’s when, he says, the British Museum started dragging its feet.”

Journalist did not even speak to Gradel or trade as he attacked them

This is an extensive and unfair criticism of the whistleblower by a journalist who has not even had the courtesy to speak to him – even at a time when Dr Gradel was conducting a major round of media interviews. Why not?

The article then questions whether a dealer buying from someone from the British Museum would have a duty to conduct due diligence, as though that did not happen. It is the fact that Dr Gradel did conduct such checks that led to his discovery, a fact that The Guardian ignores.

What it does do is talk extensively to the trade’s arch critic, Dr Christos Tsirogiannis, who says: “It’s a huge red flag,” agrees Tsirogiannis, “but on the other hand, how many dealers of antiquities out there are not dealing with unprovenanced objects? I don’t know anyone.”

As usual, in launching this attack on the trade, Dr Tsirogiannis ignores the reality of provenance surrounding ancient objects: that few, if any, have comprehensive documentation dating back to the point of creation or discovery because of the fact that they are so old and that either such paperwork never existed or has not survived.

If the journalist involved, Andrew Anthony, had dug a little deeper, spoken to someone from the Antiquities Dealers’ Association, or at least bothered to check the ADA website, he would have found all the illuminating answers he needed, from the association’s position on responsible collecting, through its mass of independently verifiable data to its analysis of ethics, due diligence, provenance and provenance research.

by ADA | Jul 17, 2023 | News, Uncategorized

Ministry’s legal head reinforces ‘innocent until proven guilty’ principle in interpreting law

The Italian Ministry of Culture has issued a potentially ground-breaking statement, following a court ruling. It challenges current thinking on cultural heritage and patrimony and reinforces private property rights.

Essentially the statement addresses conflicting priorities between private property rights and the Italian state’s desire to protect its cultural heritage, and how this conflict addresses proof of ownership.

Recent years have seen a significant shift in attitudes among state authorities and law enforcement towards the idea of reversing the burden of proof regarding the legitimate ownership of antiquities and ancient coins. This is despite private property rights being enshrined in all fundamental clauses of international human rights conventions and in both common law and natural justice. Guilty until proved innocent has almost become the new normal.

Now, however, comes evidence of a fight back against this fundamentally undemocratic idea. This statement is one of them, and it has an additional welcome twist.

It arose after Italy’s Directorate-General of the Department of Archaeology, Fine Art and Landscape sought advice from the legal department on how to interpret Article 72 of the Cultural Property Act. As Coins Weekly notes: “This article governs the import of archaeological (numismatic) objects originally from Italy and demands extensive proof of origin.”

The legal department’s head, renowned professor of law Antonio Tarasco, came back with a surprising statement, acknowledging competing views. On the one hand, some lawyers argue that protecting Italian cultural heritage is a priority that renders significant objects as state property unless private ownership can be proved (reversal of the burden of proof); on the other are lawyers who argue that private ownership should take priority except in the most exceptional circumstances.

Law professor acknowledges Court of Cassation ruling as precedent

This dichotomy led the professor to look at the part documentation has played over the years in establishing ownership rights for coins in Italy. The first thing he noted was that as late as the 1980s, retaining proof of purchase was highly unusual. But he also noted that in 2009, his department insisted that “proper documentation issued by the countries of origin” was essential in establishing the lawful circulation of objects.

Importantly, this meant that any certification issued on import had to be renewed at the appropriate time or the Italian State might take possession of the item in question.

Fast forward to 2021, however, and Italy’s Court of Cassation – the highest appeal court which focuses only on how laws are interpreted – re-established the priority of private ownership without automatically having to provide supporting documentation (innocent until proven guilty).

Professor Tarasco points out that this meets the test of proportionality and reasonableness (just as the ADA has been arguing needs to happen with the EU import licensing regulation 2019/880). Of particular note is what Professor Tarasco has to say about this: “Forcing citizens (be they collectors or professional numismatists who buy abroad) to provide (almost fiendishly extensive) proof of the legitimate origin of the coins they buy, which must even date back to before 1909 [when Italy’s patrimony law was passed], is ultimately making it more difficult to buy – and therefore import into Italy – significant numismatic material that may one day enter public collections.”

The welcome twist Professor Tarasco adds at the end of his statement argues that making imports more difficult is actually damaging to Italian cultural heritage: “If we look closely, we can see that this approach – even if applied with good intentions – will not result in Italy protecting its national cultural property, but rather losing it.”

A fascinating statement from the head of the legal department of Italy’s Ministry of Culture, then. With all this in mind, how does Professor Tarasco view Italy’s application of Article 4 of the EU regulation 2019/880 from June 2025? It insists on the sort of “fiendishly extensive” documentation and evidence that effectively reverses the burden of proof in the way he decries here. And how does he feel about the Memorandum of Understanding Italy shares with the United States, which does exactly the same?

Professor Tarasco has highlighted the importance of proportionality and reasonableness here – qualities echoed in the European Commission President’s guiding principles for policy. If the Italian government’s leading legal authority on the issue, together with its highest court, acknowledges that private property rights have priority over what may be seen as the national interest in this way, how can it continue to move forward with either the new EU law or its MoU?

by ADA | Nov 2, 2022 | News, Uncategorized, Views |

The World Customs Organisation has finally published a new report following the 2019 report, covering two years from 2019-2021, probably delayed because of the Covid 19 pandemic. Its results once again show that global levels of illicit trade in cultural property are far lower than claimed.

In the press release we read: “This year, the analysis provided in this Report is based on data collected from 138 Member administrations. Previously composed of six sections, the Report now covers seven key areas of risk in the context of Customs enforcement: Anti-money laundering and terrorist financing; Cultural heritage; Drugs; Environment; IPR, health and safety; Revenue; and Security.”

It also states: “The analysis contained in this Report is mainly based on the collection of data from the WCO Customs Enforcement Network (CEN) — a database of worldwide Customs seizures and offences”….

“However, the CEN database relies heavily on voluntary submissions by Members hence the quantity and quality of the data submitted to the system has its limitations”…

“However, as part of this new methodology, the data and information sources used to elaborate this Report has been enlarged to include various open sources.”

While the rest of the report might be “mainly based on the collection of data from the WCO Customs Enforcement Network (CEN)”, in the introduction to the Cultural Heritage chapter on page 57, the WCO goes further, admitting: “Unfortunately, the data received through the WCO’s Customs Enforcement Network (CEN) in 2020-2021 being incomplete, the following analysis will be mostly based on open source information.”

Case studies based on media reports rather than primary research

The result for the Cultural Heritage section is that most of the case studies are based on newspaper articles, sometimes even on events that happened decades ago, and have nothing to do with recent trafficking activities. This is alarming as much of the problem with false data plaguing the cultural property sector stems from misreporting in the media. It is even more alarming when the misleading picture created by a surface reading of the chapter will undoubtedly be used as ‘evidence’ in future campaigns against the art market, as past reports have been.

The WCO is supposed to report recent and reliable figures, like figure 3 on page 35, showing that the number of worldwide reported cultural goods cases for 2021 is a mere 156, that is 1.1 case per reporting country….

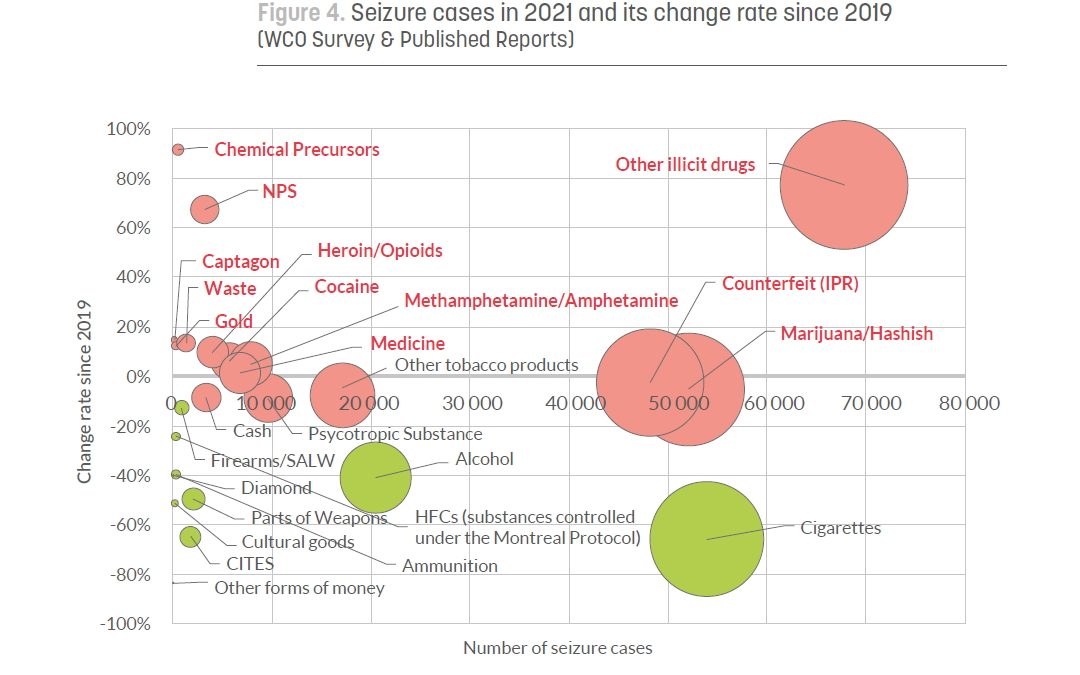

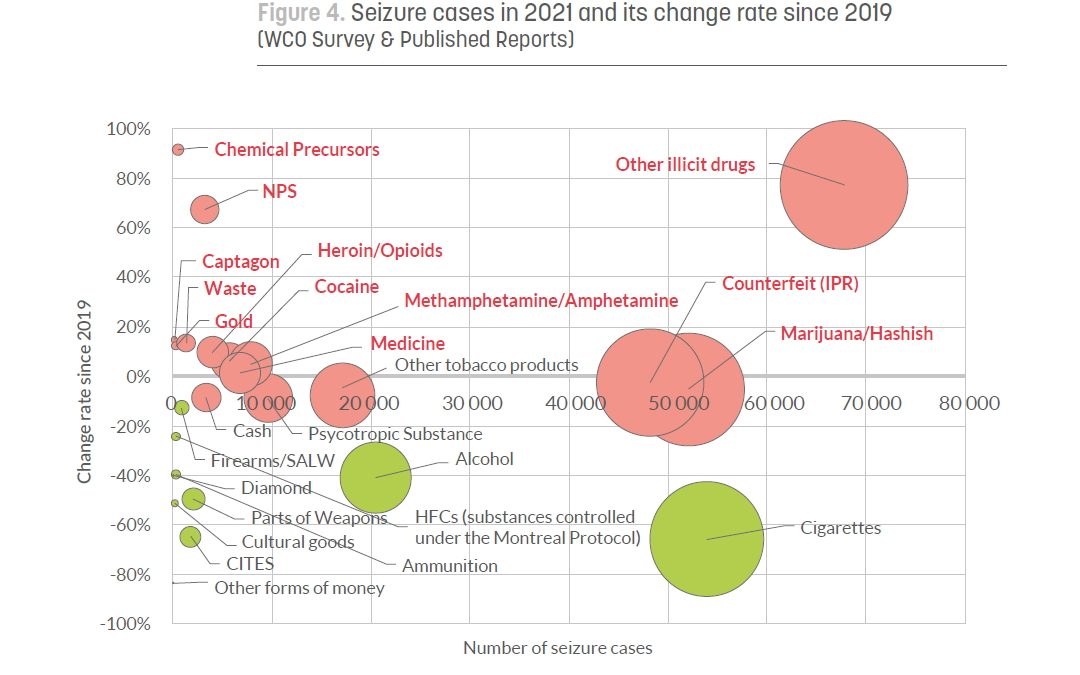

A newly introduced graph (shown here) in the WCO report (Page 17, Fig. 4) reveals precisely what the ADA and its fellow association IADAA have reported over the past years: the illicit trade in cultural heritage is so small that it barely shows in the statistics. Not only is it the smallest category – so small that you have to look carefully in case you miss it – but the graph also shows that seizures have fallen by around 50% between 2019 and 2021.

Let’s not forget, too, that the Cultural Heritage category is not limited to antiquities, as so many mistakenly believe; it covers 13 distinct sub-categories, including: all forms of art, antiques and collectables, household items, flora and fauna, books and manuscripts. In 2019, the top three categories of recovered item sub-categories were: Fauna, Flora, Minerals, Anatomy & Fossils; Other; and Hand-painted or Hand-drawn articles and works of art. No mention of antiquities, which did not even warrant its own sub-category.

All of this begs the question as to why, in its chapter on Cultural Heritage, the WCO has chosen to focus exclusively on photographs of seized antiquities (at least one of which seems to be a fake) alongside fossils and coins. The choice appears politically charged.Consistent reporting of

The WCO has stated in the past and here that there is under-reporting of crime in the culture sector and that it only counts seizures and cases reported via the Customs Enforcement Network (CEN), the implication being that the problem is much larger.

Figures consistently show low rate of illicit trade in cultural property

However, the miniscule share of illicit trade represented in its reports over the years by cultural property has been consistent, only now augmented by media reports not sourced via the CEN.

It further boosts this chapter of the report with a summary of Pandora VI, the latest in a seven-year campaign of international operations involving mass seizures and arrests. What the WCO, Europol or Interpol have never done, however, is to provide data on how many of their seizures and arrests later prove to be justified and how many were shown to be related to terrorism financing. It is not just the trade asking for these figures, academic investigators want them too to see how effective these operations are.

Previously the WCO has attempted to rebut the ADA and IADAA’s analysis of its reports, stating that the figures cannot be relied on. As our analysis always provides transparent sources for the data emanating from the reports, however, the WCO’s case against our analysis simply does not stand up.

Ultimately, its figures must be indicative of the global state of affairs; if they are misleading, why publish them?

by ADA | Mar 28, 2022 | News, Uncategorized |

ADA Members are aware and deeply saddened by the devastating consequences of the unfolding human tragedy in Ukraine. It is a country with a rich history from the earliest times and while Ukrainian origin antiquities are not so commonly found in our market, ADA members are on the alert to any cultural property which may have originated from that region. This follows on from the ADA’s existing vigilance over antiquities possibly originating from the Crimea, in place since that region was annexed by Russia in 2014.

The Code of Conduct of the Antiquities Dealers’ Association provides specific guidance to Members on the dangers to cultural property in war-torn countries, under the heading ‘Conflict Zones’.

Recent Comments